|

|

|

|

#13426 | |

|

Seize life. Be an ermine.

Join Date: Jul 2001

Location: My house

Casino cash: $1388491

|

Quote:

I bought RCL back in 2014 and made such a killing on it that I never ended up down even during the shutdown. I just lost a lot of profit on paper. I bought NCLH in February of 2020, which was the worst timing possible. I'm down about 50 percent on it right now. And then CUK has been a disaster. I had a ton of it that I bought back in probably 2016 or so. It lost 30 percent or so before the shutdowns and I was hanging on to it because I was just collecting the dividends and could wait for it to go back up. But then March of 2020 hit and they all stopped the dividends and now I'm down 82 percent on it. Again, though, no place to go but up at this point so I'm keeping it. I'm in SPY and QQQ in small amounts. I figured I'd go low-maintenance and try them out, but I like shopping for stocks so I haven't really increased them to any significant level.

__________________

Active fan of the greatest team in NFL history. |

|

|

Posts: 143,170

|

|

|

|

#13427 | |

|

Fish are scared of me

Join Date: Nov 2001

Casino cash: $-99523

|

Quote:

Man, when she got going her funds were rocking and rolling with 100% returns. She became a cult leader. What I've read on more than one occasion is that she became a threat to other hedge funds and they collectively took aggressive short selling attacks on a lot of her investments. Don't know if that's factual but it makes sense. She does her homework and she's not stupid and has a large advisory team. Man, when she got going her funds were rocking and rolling with 100% returns. She became a cult leader. What I've read on more than one occasion is that she became a threat to other hedge funds and they collectively took aggressive short selling attacks on a lot of her investments. Don't know if that's factual but it makes sense. She does her homework and she's not stupid and has a large advisory team.That being said, it seems like short selling has become just a thing in the last 4-5 years that have really destroyed the market. I just don't remember it going on at these levels 10-20 years ago. Warren Buffett says the main reason he doesn't split BERK.A is he doesn't want short attacks. |

|

|

Posts: 40,650

|

|

|

|

#13428 | |

|

Supporter

Join Date: Apr 2007

Location: Scott City KS

Casino cash: $384734

|

Quote:

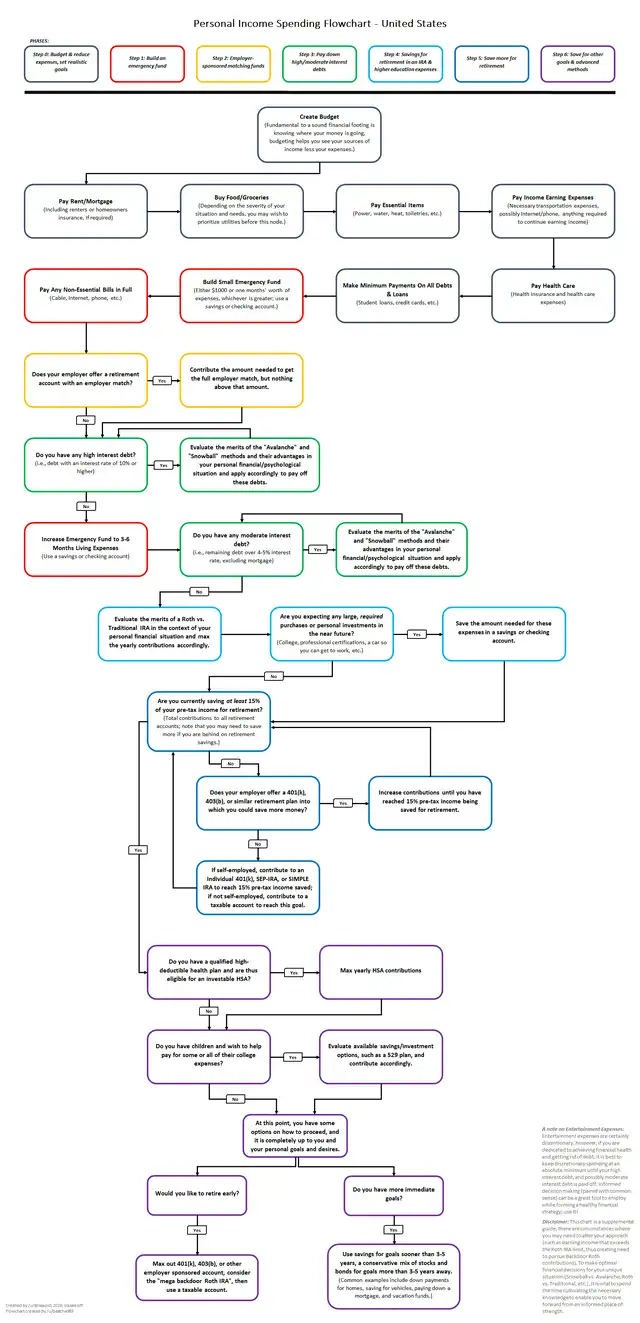

I have some of all 3. In terms of investing, the big key is doing it. If you can get an automatic withdrawal, that automatically flows into an instrument that you don’t have to manage that is the best option for most people. In my tax sheltered account I have it going into a target dated fund that automatically rebalances to get more conservative as I get older. There are some largely agreed upon flowcharts for personal finance. Big thing is if your company matches a 401K do that. The free money aspect is too easy. If the fees are high in the 401K I can listen to arguments for avoiding it if the fees are high. I’m a fan of Roth because I feel taxes are going up not down, even in retirement, but some of both is a good strategy. The biggest thing is get it in a retirement account. IRA has a 6000 contribution limit but you can do 6000 in a Roth and 6000 in a traditional. If you’re married your wife has the same limits. If you have a company sponsored 401K the limit is 14000. That’s where I’d plow the majority of your investment. Big thing is emergency fund -> 401K up to the match -> CC debt -> normally you’d pay off consumer debt but if the rate is low I wouldn’t -> max out retirement. There are a million flow charts but they are all pretty similar to this.  Last edited by Buehler445; 05-26-2023 at 03:30 PM.. |

|

|

Posts: 58,172

|

|

|

|

#13429 | |

|

Seize life. Be an ermine.

Join Date: Jul 2001

Location: My house

Casino cash: $1388491

|

Quote:

I have a stock in one company now (MPW) that's under aggressive attack by short sellers, and they're suing the short sellers. I'm hoping that the company is right and the short sellers are wrong since the price has declined notably with the war underway.

__________________

Active fan of the greatest team in NFL history. |

|

|

Posts: 143,170

|

|

|

|

#13430 | |

|

Stay down bitch!

Join Date: Jun 2001

Location: Plano, TX

Casino cash: $5490670

|

Quote:

__________________

Disappointing my parents since 1976 |

|

|

Posts: 9,361

|

|

|

|

#13431 | |

|

Spooky Action

Join Date: Dec 2003

Casino cash: $742558

|

Quote:

|

|

|

Posts: 6,480

|

|

|

|

#13432 | |

|

Mod Team

Join Date: Sep 2011

Location: Valley of the hot as ****

Casino cash: $1900

|

Quote:

If you just want to manage one fund look at VTSAX. Vanguard Total Stock Market Index Fund is designed to provide investors with exposure to the entire U.S. equity market, including small-, mid-, and large-cap growth and value stocks. |

|

|

Posts: 46,146

|

|

|

|

#13433 | |

|

Grand champ

Join Date: Sep 2007

Casino cash: $152369

|

Quote:

My biggest issue lately is that Iíve got a lot of cash in a money market thatís only getting, like, a .00003 return. Thereís no reason a six figure account should only be getting me $100 per year in returns. I appreciate not having any risk but inflation is eating those savings up far more quickly than Iím comfortable with. |

|

|

Posts: 45,582

|

|

|

|

#13434 | |

|

Supporter

Join Date: Apr 2007

Location: Scott City KS

Casino cash: $384734

|

Quote:

|

|

|

Posts: 58,172

|

|

|

|

#13435 | |

|

Politically Incorrect

Join Date: Feb 2009

Location: Scottsdale, AZ

Casino cash: $841110

|

Quote:

If you are under 40, you should find a financial advisor. You're flushing money down the toilet.

__________________

"The only difference between sex for free and sex for money is that sex for free costs you a WHOLE LOT more!" ~Redd Foxx~  "The men who drafted Patrick Mahomes"

|

|

|

Posts: 52,824

|

|

|

|

#13436 | |

|

Supporter

Join Date: Apr 2007

Location: Scott City KS

Casino cash: $384734

|

Quote:

Up until interest rates moved for the first time in 2 decades I had it in a local bank money market too. If his intention is to invest it, he should. If his intention is to find a better yielding money market, he can do that without a financial advisor. |

|

|

Posts: 58,172

|

|

|

|

#13437 | |

|

Grand champ

Join Date: Sep 2007

Casino cash: $152369

|

Quote:

But over time, things and people change and I'm finally ready to put a good chunk of this change in the market or a HYSA at the very least to cut the effects of inflation. I think my emergency fund really only needs to be, idk, maybe $30,000 at most. 6 months of bills/expenses might be $10,000-$20,000. I'm driving a 20-year old car so she could take a shit on me at any moment. Other than that, the rest of the cash should be put to better use. It's just a matter of what type of account/investment, where and how much. |

|

|

Posts: 45,582

|

|

|

|

#13438 | |||

|

Grand champ

Join Date: Sep 2007

Casino cash: $152369

|

Quote:

Quote:

Quote:

I am 100% not built for the individual stock game lol y'all are different. My next issue is the constant threat of this looming recession. What does everyone make of that? Part of me thinks it'd be best to just park the bulk of this cash into a HYSA and ride it out 'til the storm's over. It looks like you can find quite a few with returns between 3-5%. The other part of me says **** it, throw it into some ETFs. Even if/when the market dips, it'll recover down the line and it's best to be in when that recovery starts. |

|||

|

Posts: 45,582

|

|

|

|

#13439 | |

|

Supporter

Join Date: Apr 2007

Location: Scott City KS

Casino cash: $384734

|

Quote:

If you've got 100K in your dogshit money market account, I'd do the following. I've got my shit with Vanguard, but I think they're all pretty much the same. Choose the brokerage of your choice, just make sure your brokerage has a money market fund that yields. Open brokerage account. Link to your bank account. Vanguard has free ACH. It takes a couple days both ways to clear, so it's not a huge deal to get money back and forth. There are limits for IRAs. If you make more than 138K (single), 218K (MFJ), you can't do contributions to a ROTH. You can do a traditional, but it won't be deductible, so I wouldn't do it. There are some backdoor ROTH options if you make more than that, but you need some CPA/Advisor help. If you're below those levels, fire away on the IRAs. Start a ROTH IRA. Put $6,500 in it (that's the limit). I have mine in a target dated fund. Mine is in VFIFX, but choose your projected retirement date and set it and forget it. Put $6,500 in your traditional IRA (That's the limit) I'd put the emergency fund and car amount in a money market fund. If you're rolling a 20 year old car, probably 20K. So if you have 20K for a car and 20K for emergencies, put 40K in the money market. VMFXX is the one I'm using. The interest will be taxable, but so is the dogshit interest in your bank account. That leaves 47,000 to invest. I'd stick 35,000 in VOO, it's an S&P Index fund. Then put 12,000 VIGAX. It's a Vanguard Growth ETF. There are a few options here, but I'd just get it in there. Any gains will be taxable when you sell. There will be some dividends that will be taxable income, but so is your dogshit interest in your bank account. That gets you to 100K. Adjust numbers to reflect what you have. This is what I'd do. If you're more risk averse than that, you can leave more in the money market, but I'd definitely get some in a S&P ETF and forget about it. If lump sum scares you, put it in VMFXX and split it into 12 increments and Dollar Cost Average it over a year, but after the big pullback, I wouldn't worry about it. Just get it in there. In terms of management, it doesn't have to be any more than what you're doing to get it in the money market. Vanguard's site lets you pull directly from your account and into whatever fund you want. And you can automate it if you want. Probably from what you're doing, I'd probably just transfer it to the money market and distribute it to wherever you want (IRA, ROTH, Taxed Instruments) once a year or so. JMO. |

|

|

Posts: 58,172

|

|

|

|

#13440 |

|

Roy E.

Join Date: Sep 2005

Location: Olathe, KS

Casino cash: $10099646

|

Open up a high yield savings account. There are plenty of places to choose from with rates over 4%, and as high as 4.85%.

https://www.bankrate.com/banking/sav...ings-accounts/ Assuming you put in $100,000, and earn 4.85% compounded daily, you should get $4969.20 in interest after 1 year according to this compound interest calculator. https://www.bankrate.com/banking/sav...gs-calculator/ If you want to go with CD's, you can get well over 5%. https://www.bankrate.com/banking/cds/cd-rates/ I opened a high yield savings account a few months ago with UFB Direct, and was able to get an interest rate of 5.02% APY. I was tired of getting 0.5% at my local bank, and before that it was at 0.1% for the longest time. |

|

Posts: 23,128

|

|

|

|

|