|

|

|

|

#13411 | |

|

2 Legit 2 Colquitt

Join Date: Sep 2010

Casino cash: $3485754

|

Quote:

All of this is pre tax Roth for me so taxes aren't a factor. I think there are transaction fees involved but those are all a flat fee. Personally, I wouldn't liquidate your positions, but selling off a chunk after a growth spurt is not a bad idea to lock in some of your gains. |

|

|

Posts: 4,764

|

|

|

|

#13412 |

|

Veteran

Join Date: Oct 2002

Location: Bismarck

Casino cash: $348196

|

Yes it has. She used to have a crazy fan base that followed everything she does, hell I even remember seeing T shirts with her face on them. Seems like the big thing she did was own TSLA before it went apeshit and split a couple years ago. Lots of people did and didn't get their face on a T shirt.

Since you brought up NVDA, for anyone interested in any tickers like TSLY, there was a new one based on NVDA recently called NVDY that came out. Not sure what the dividend will be since it just opened and I'm not in it. I'm out of work for a few weeks now that I've had surgery on my elbow and wrist so I decided to get back into trading more to ease the boredom. Bought LYFT a couple days ago for 8 and sold it this morning for 8.20. It's not crazy great, but it helps to pass the time I guess. |

|

Posts: 1,395

|

|

|

|

#13413 |

|

Seize life. Be an ermine.

Join Date: Jul 2001

Location: My house

Casino cash: $1318491

|

Yeah. I really like her philosophy of investing in innovation. It seems like a great idea. Of course, those were the companies that got clobbered the most in 2022, so to some extent she or I or both got nailed by bad timing. But it seems like she's also made far bigger strategic mistakes, because I shouldn't still be down by 60 percent.

And you hear that, hog? I'm coming for you!

__________________

Active fan of the greatest team in NFL history. |

|

Posts: 143,223

|

|

|

|

#13414 | |

|

Seize life. Be an ermine.

Join Date: Jul 2001

Location: My house

Casino cash: $1318491

|

Quote:

Dang, I hate paying taxes on those gains, though.

__________________

Active fan of the greatest team in NFL history. |

|

|

Posts: 143,223

|

|

|

|

#13415 | |

|

Supporter

Join Date: Apr 2007

Location: Scott City KS

Casino cash: $314734

|

Quote:

|

|

|

Posts: 58,239

|

|

|

|

#13416 |

|

Grand champ

Join Date: Sep 2007

Casino cash: $82369

|

I had no experience in investing and decided to dip my feet in the water maybe a year ago with some airline and cruise stocks thinking they'd rebound after COVID (stupid lol).

I'm no day trader and realize I know absolutely jack and shit about any of this, so I recently parked some cash into VOO. I hope to be able to just keep that money in there for the next 30 years and see some growth. I've been considering other ETFs as well. Is that an advisable course of action in the eyes of the financial gurus of CP? |

|

Posts: 45,664

|

|

|

|

#13417 | |

|

Seize life. Be an ermine.

Join Date: Jul 2001

Location: My house

Casino cash: $1318491

|

Quote:

The cruise lines are all up notably this month. I hope that's a trend that will continue. If they ever get back to pre-pandemic levels, they'll double in price. I could really use that since I rode them all the way down in 2020.

__________________

Active fan of the greatest team in NFL history. |

|

|

Posts: 143,223

|

|

|

|

#13418 |

|

Grand champ

Join Date: Sep 2007

Casino cash: $82369

|

Hah, yeah, I'm actually up on Royal Caribbean, which is encouraging, but down on all the others. At this point, I've been holding the bag so long that I will likely just continue to do so.

|

|

Posts: 45,664

|

|

|

|

#13419 |

|

Grand champ

Join Date: Sep 2007

Casino cash: $82369

|

Is anyone in on SPY, QQQ or SCHD?

|

|

Posts: 45,664

|

|

|

|

#13420 | |

|

Seize life. Be an ermine.

Join Date: Jul 2001

Location: My house

Casino cash: $1318491

|

Quote:

I bought RCL back in 2014 and made such a killing on it that I never ended up down even during the shutdown. I just lost a lot of profit on paper. I bought NCLH in February of 2020, which was the worst timing possible. I'm down about 50 percent on it right now. And then CUK has been a disaster. I had a ton of it that I bought back in probably 2016 or so. It lost 30 percent or so before the shutdowns and I was hanging on to it because I was just collecting the dividends and could wait for it to go back up. But then March of 2020 hit and they all stopped the dividends and now I'm down 82 percent on it. Again, though, no place to go but up at this point so I'm keeping it. I'm in SPY and QQQ in small amounts. I figured I'd go low-maintenance and try them out, but I like shopping for stocks so I haven't really increased them to any significant level.

__________________

Active fan of the greatest team in NFL history. |

|

|

Posts: 143,223

|

|

|

|

#13421 | |

|

Fish are scared of me

Join Date: Nov 2001

Casino cash: $-159523

|

Quote:

Man, when she got going her funds were rocking and rolling with 100% returns. She became a cult leader. What I've read on more than one occasion is that she became a threat to other hedge funds and they collectively took aggressive short selling attacks on a lot of her investments. Don't know if that's factual but it makes sense. She does her homework and she's not stupid and has a large advisory team. Man, when she got going her funds were rocking and rolling with 100% returns. She became a cult leader. What I've read on more than one occasion is that she became a threat to other hedge funds and they collectively took aggressive short selling attacks on a lot of her investments. Don't know if that's factual but it makes sense. She does her homework and she's not stupid and has a large advisory team.That being said, it seems like short selling has become just a thing in the last 4-5 years that have really destroyed the market. I just don't remember it going on at these levels 10-20 years ago. Warren Buffett says the main reason he doesn't split BERK.A is he doesn't want short attacks. |

|

|

Posts: 40,646

|

|

|

|

#13422 | |

|

Supporter

Join Date: Apr 2007

Location: Scott City KS

Casino cash: $314734

|

Quote:

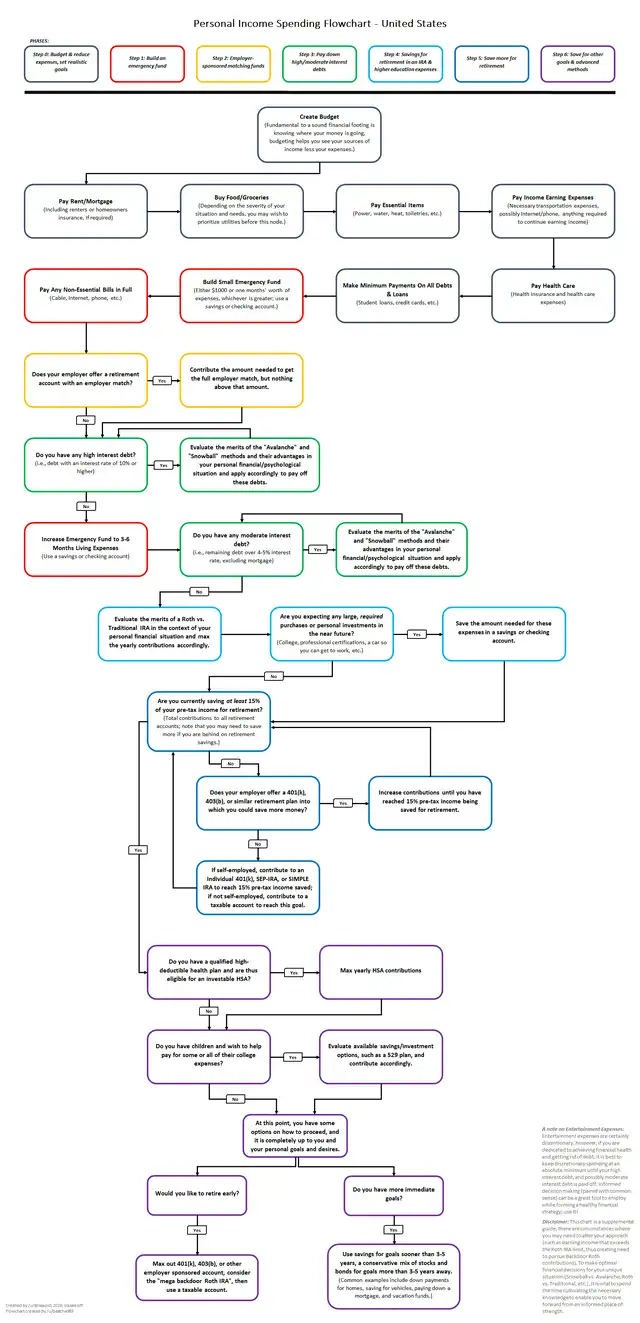

I have some of all 3. In terms of investing, the big key is doing it. If you can get an automatic withdrawal, that automatically flows into an instrument that you don’t have to manage that is the best option for most people. In my tax sheltered account I have it going into a target dated fund that automatically rebalances to get more conservative as I get older. There are some largely agreed upon flowcharts for personal finance. Big thing is if your company matches a 401K do that. The free money aspect is too easy. If the fees are high in the 401K I can listen to arguments for avoiding it if the fees are high. I’m a fan of Roth because I feel taxes are going up not down, even in retirement, but some of both is a good strategy. The biggest thing is get it in a retirement account. IRA has a 6000 contribution limit but you can do 6000 in a Roth and 6000 in a traditional. If you’re married your wife has the same limits. If you have a company sponsored 401K the limit is 14000. That’s where I’d plow the majority of your investment. Big thing is emergency fund -> 401K up to the match -> CC debt -> normally you’d pay off consumer debt but if the rate is low I wouldn’t -> max out retirement. There are a million flow charts but they are all pretty similar to this.  Last edited by Buehler445; 05-26-2023 at 03:30 PM.. |

|

|

Posts: 58,239

|

|

|

|

#13423 | |

|

Seize life. Be an ermine.

Join Date: Jul 2001

Location: My house

Casino cash: $1318491

|

Quote:

I have a stock in one company now (MPW) that's under aggressive attack by short sellers, and they're suing the short sellers. I'm hoping that the company is right and the short sellers are wrong since the price has declined notably with the war underway.

__________________

Active fan of the greatest team in NFL history. |

|

|

Posts: 143,223

|

|

|

|

#13424 | |

|

Stay down bitch!

Join Date: Jun 2001

Location: Plano, TX

Casino cash: $5480670

|

Quote:

__________________

Disappointing my parents since 1976 |

|

|

Posts: 9,362

|

|

|

|

#13425 | |

|

Spooky Action

Join Date: Dec 2003

Casino cash: $672558

|

Quote:

|

|

|

Posts: 6,490

|

|

|

|

|