Quote:

Originally Posted by TwistedChief

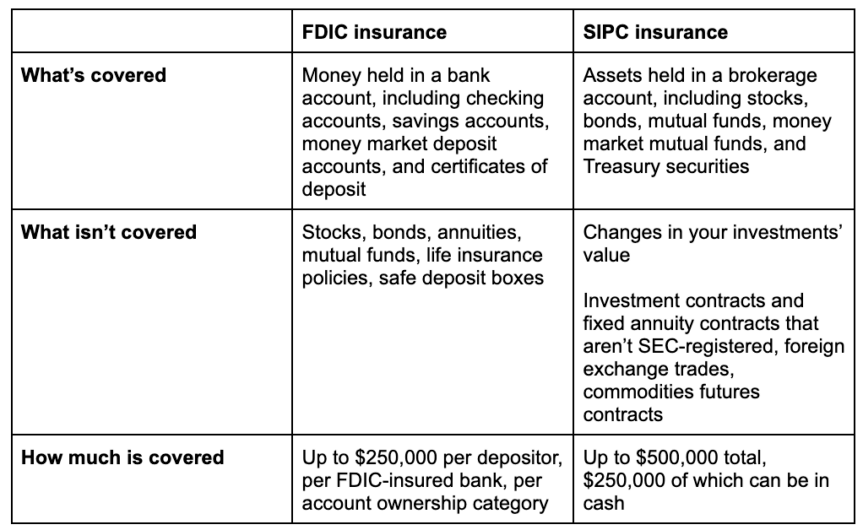

Obviously, Vanguard isnít a bank. So thereís no FDIC protection. But if you have it in the Vanguard money fund, itís as safe as anything on planet earth. No need to spread it beyond that. Any cash you need for regular outlays keep in your bank but the rest of the cash you want to preserve should go to the Vanguards of the world.

I can understand people being lazy about this in a world of zero rates. Then a bank or a money market fund were all the same thing. But now most banks are still paying maybe 1-2pct (though other banks are trying to attract deposits and paying more) while money funds are paying levels approaching 5pct.

So the 1-2pct option is basically a loan to a bank where the 5pct option is a loan to the government. You receive a much better return on the latter and have significantly less risk (if you want to bring up the debt ceiling, we can discuss, but thatís a longer conversation and doesnít remotely change this conclusion).

These Silicon Valley idiots were exceptionally lazy and careless in their cash management. And that allowed SVB to operate as it did until it couldnít.

|

Investments are protected in similar fashion, by SIPC though correct? So just as important to have them spread out as well?

Thanks for your information.